Fixed Annuity

Every good financial plan should have a good solid foundation. Fixed Annuities can offer this.

A fixed Annuity offers lifetime income that you can never outlive giving senior peace of mind in their golden years.

Many Fixed Annuities offer some form of access to the account through free withdrawals such as 10% free or access to the earnings.

They may also allow the owner to access the account in the event of Long Term Care needs.

A fixed Annuity offers lifetime income that you can never outlive giving senior peace of mind in their golden years.

Many Fixed Annuities offer some form of access to the account through free withdrawals such as 10% free or access to the earnings.

They may also allow the owner to access the account in the event of Long Term Care needs.

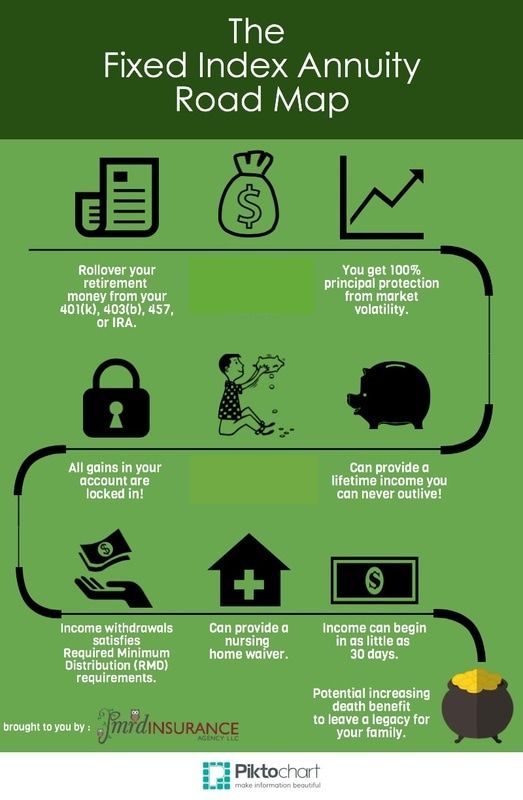

Fixed Index Annuity

|

As the name implies, Fixed Indexed Annuities are Fixed Annuities. This is important because you get the low risk appeal of a guaranteed minimum return with some up-side potential.

The client’s money is not in the market but receives rates of return base on the index returns., usually the S&P 500. Due to the money not being exposed to negative returns, there are usually caps, spreads or participation rate associated with the Fixed Index Annuity. As with any Fixed Annuity, the earnings grow Tax Deferred. This allow your money to grow on a compounded basis in years when the stock index is up. In years when the stock index is down, the minimum return is 0%. You are protected from the negative returns in the market. Indexed Annuities have evolved to provide Income Riders for lifetime income and some can even help with Long Term Care needs. Give us a call to help you with your next qualified or non-qualified annuity sale. We will find the right product for your client. |

Give us a call to find the right annuity for you or your client